The California Public Utilities Commission (CPUC) has launched a $280 million grant program to help low-income residents in the state deploy battery energy storage systems and solar power generation facilities.

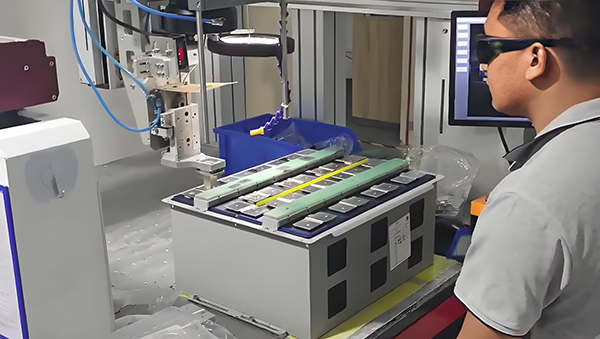

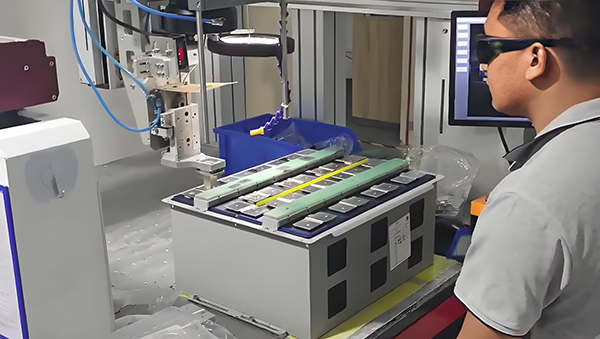

The CPUC's Self-Generation Incentive Program (SGIP) will provide financial support for battery energy storage systems (storage capacity ≤ 15kWh) and solar power generation facilities (≤ 5kW) deployed by each household user. The commission said that if household users plan to deploy larger solar power generation facilities and battery energy storage systems, they will need to prove the rationality of their loads in order to receive additional incentives.

The Self-Generation Incentive Program (SGIP) will combine financial incentives with the Inflation Reduction Act (IRA) tax credit policy to cover the cost of deploying energy storage systems.

The program applies to low-income households served by investor-owned utilities (IOUs), utilities, and community choice aggregators (CCAs).

The SGIP budget for these customers is $252 million for residential solar-plus-storage systems and $13 million for residential storage systems through December 2025.

Qualifying households can receive $1,100/kWh for battery storage and $3,100/kWh for residential solar.

Households applying for funding need to prove they meet low-income criteria, which is equal to or less than 80% of the area median income, and then contact the California Public Utilities Commission (CPUC) to approve developers to participate in the program.

Developers will pay 50% of the SGIP upfront for users, and users can avoid out-of-pocket costs until the deployment is completed and they are guaranteed to receive the full amount.

Users have up to one year to meet the program requirements before they can receive the incentive. The CPUC said the one-year period gives users time to participate in demand response programs, which will change their electricity use based on grid needs.

As the CPUC looks to use IRA tax credits to fund these projects, the U.S. House Ways and Means Committee has just introduced a budget reconciliation bill that would drastically cut IRA tax credits.

The bill includes proposals such as ending the Section 25D residential energy tax credit by the end of this year, cutting the investment tax credit (ITC) for large projects by 2028 at the latest, eliminating the production tax credit (PTC) entirely after 2031, and ending the 45X advanced manufacturing and clean hydrogen tax credits earlier than expected.

The CPUC noted in a fact sheet on the plan that only in combination with the IRA tax credit would it be possible to fully fund the costs of solar and storage systems deployed by customers.